For Insurance

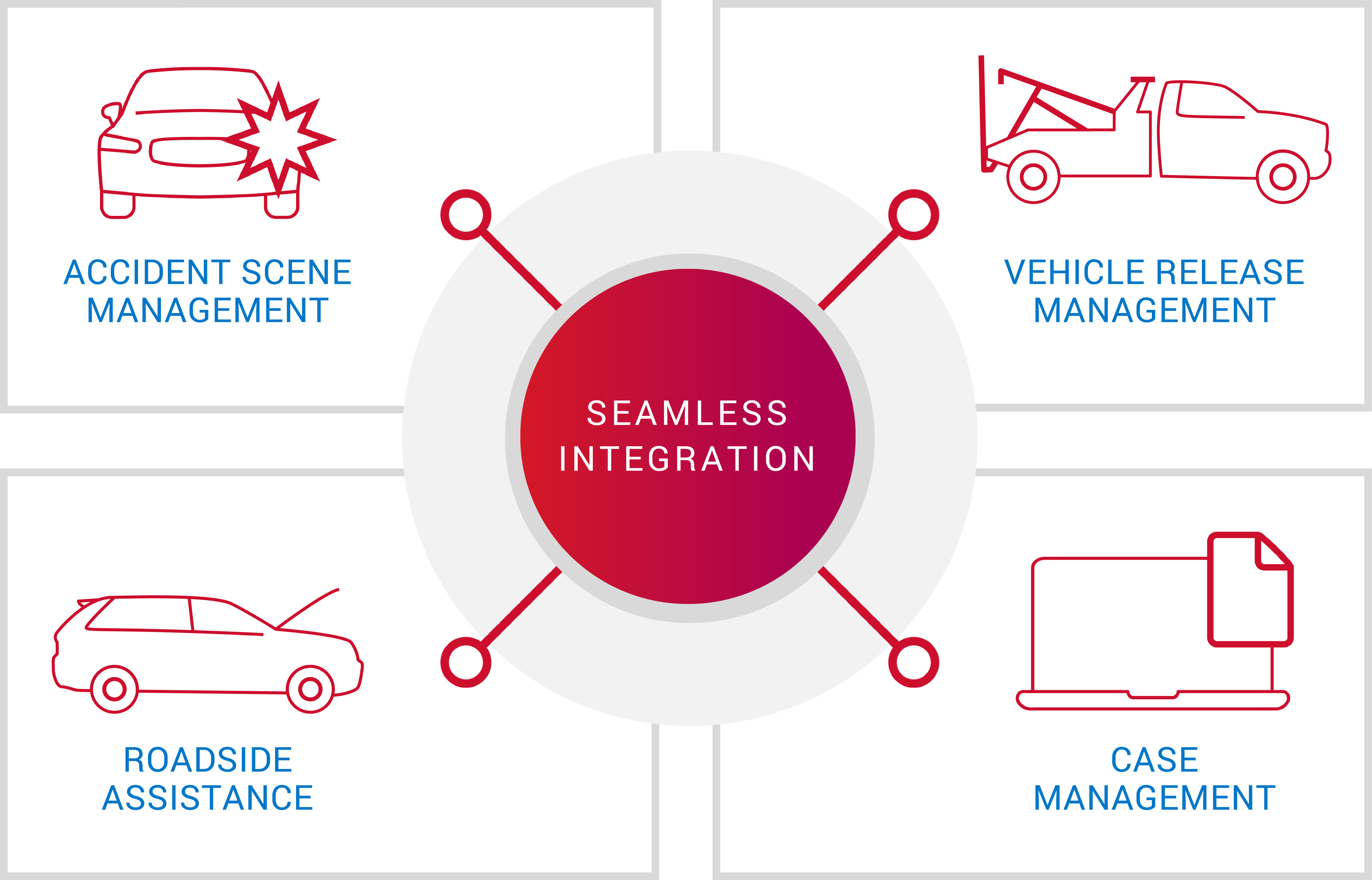

We’re here to help you help your customers. Whether it’s a simple roadside assistance request, like a flat tire or dead battery, or something more severe like an accident, our goal is to ensure your brand is the hero coming in to resolve the problem.

After all, this level of care is what creates the long-term satisfaction and loyalty you want. When you offer your customers the most efficient and effective driver assistance services available, growing your business gets that much easier.